Deweloper ma 14 dni na reklamację poznaj swoje prawa!

Deweloper ma 14 dni na reklamację. Dowiedz się, jakie masz prawa, co oznacza brak odpowiedzi i jak działa rękojmia. Sprawdź nasz poradnik!

Klaudia Kucharska

18 października 2025

Deweloper ma 14 dni na reklamację. Dowiedz się, jakie masz prawa, co oznacza brak odpowiedzi i jak działa rękojmia. Sprawdź nasz poradnik!

Klaudia Kucharska

18 października 2025

Pszczelna.pl to portal, który łączy pasjonatów rynku nieruchomości. Nasz zespół autorów składa się z ekspertów, którzy dzielą się swoją wiedzą na temat najnowszych trendów, analiz rynkowych oraz praktycznych porad dla kupujących i sprzedających. Znajdziesz tu artykuły, które pomogą Ci podejmować świadome decyzje, niezależnie od tego, czy planujesz zakup nowego mieszkania, czy sprzedaż swojej nieruchomości. Zachęcamy do zgłębiania naszych treści i dołączenia do społeczności, która z pasją podchodzi do tematu nieruchomości!

Szukasz cen wynajmu mieszkania w Chorwacji? Sprawdź koszty krótkoterminowe i długoterminowe. Odkryj, jak zaplanować budżet i uniknąć ukrytych opłat.

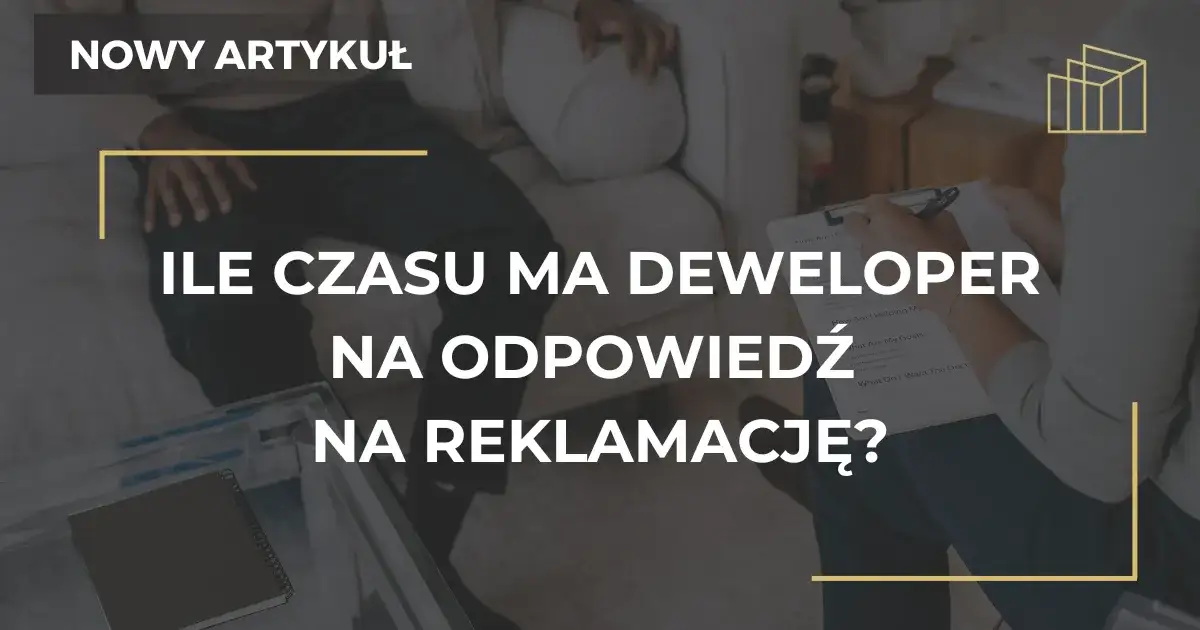

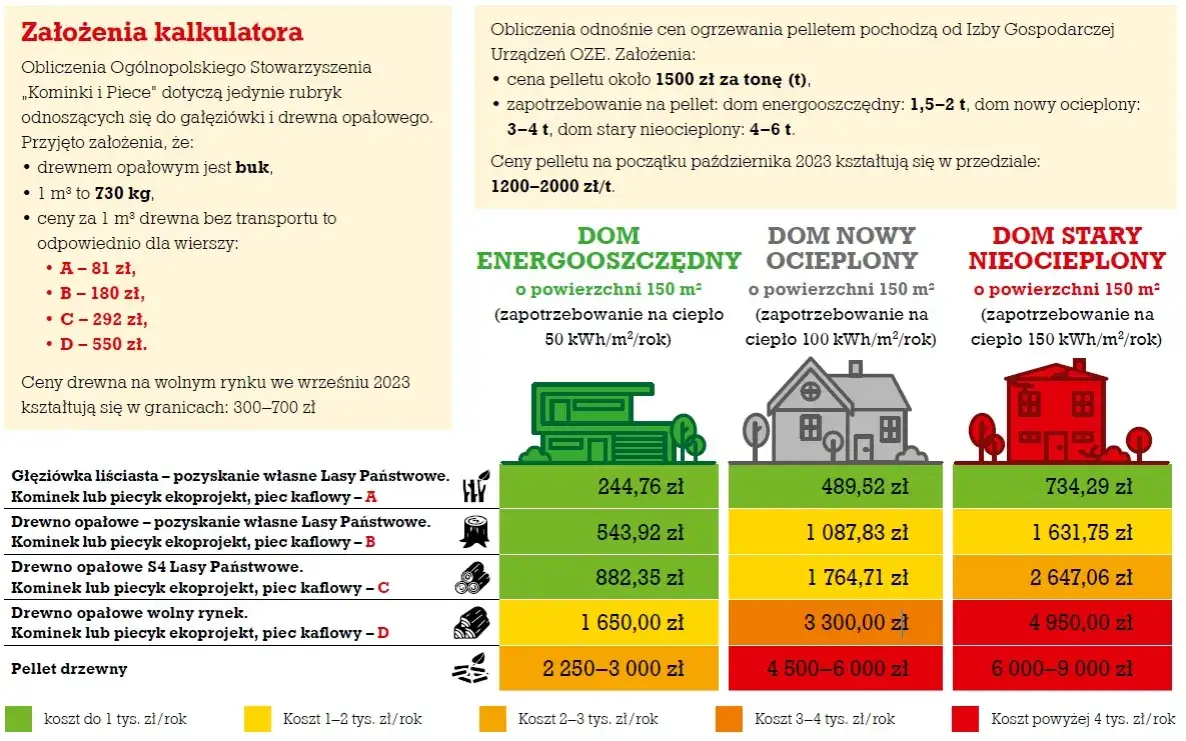

Wybierasz ogrzewanie mieszkania? Porównaj koszty, wydajność i ekologię MPEC, gazu, prądu i pomp ciepła. Odkryj sposoby na niższe rachunki!

Spółdzielnia czy wspólnota mieszkaniowa? Poznaj kluczowe różnice w zarządzaniu, własności i kosztach. Dowiedz się, która forma jest dla Ciebie lepsza!

Eliza Walczak

17 października 2025

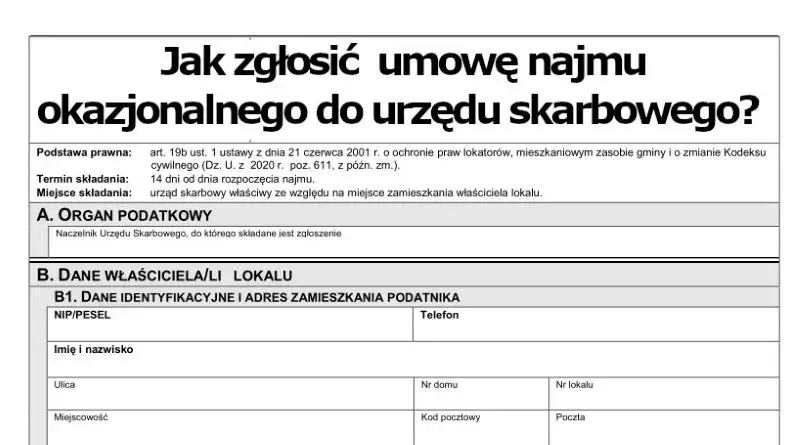

Jak zgłosić wynajem mieszkania do US? Pełny przewodnik po ryczałcie, terminach i obowiązkach dla najmu tradycyjnego i okazjonalnego. Uniknij błędów!

Dowiedz się, ile płacą skupy nieruchomości: poznaj widełki cenowe (70-90% wartości), czynniki obniżające ofertę i proces sprzedaży. Sprawdź, czy to opcja dla Ciebie!

Szukasz cen wynajmu mieszkania w Chorwacji? Sprawdź koszty krótkoterminowe i długoterminowe. Odkryj, jak zaplanować budżet i uniknąć ukrytych opłat.

Klaudia Kucharska

18 października 2025

Wybierasz ogrzewanie mieszkania? Porównaj koszty, wydajność i ekologię MPEC, gazu, prądu i pomp ciepła. Odkryj sposoby na niższe rachunki!

Eliza Walczak

18 października 2025

Spółdzielnia czy wspólnota mieszkaniowa? Poznaj kluczowe różnice w zarządzaniu, własności i kosztach. Dowiedz się, która forma jest dla Ciebie lepsza!

Eliza Walczak

17 października 2025

Jak zgłosić wynajem mieszkania do US? Pełny przewodnik po ryczałcie, terminach i obowiązkach dla najmu tradycyjnego i okazjonalnego. Uniknij błędów!

Eliza Walczak

17 października 2025

Dowiedz się, ile płacą skupy nieruchomości: poznaj widełki cenowe (70-90% wartości), czynniki obniżające ofertę i proces sprzedaży. Sprawdź, czy to opcja dla Ciebie!

Bianka Gajewska

17 października 2025

Dowiedz się, dlaczego deweloperzy ukrywają ceny mieszkań. Poznaj strategie, jak uzyskać informacje i skutecznie negocjować cenę.

Odbiór mieszkania od dewelopera? Poznaj prawa, listę kontrolną i procedurę odbioru. Zabezpiecz swoją inwestycję! Sprawdź nasz przewodnik.

O co zapytać dewelopera przed zakupem mieszkania? Sprawdź nasz przewodnik! Uniknij pułapek, zabezpiecz finanse i wybierz idealną nieruchomość.

Kupujesz mieszkanie od dewelopera? Poznaj listę kluczowych pytań, które pomogą Ci uniknąć pułapek i dokonać bezpiecznego zakupu. Sprawdź nasz poradnik!

Kompleksowy przewodnik po odbiorze mieszkania od dewelopera. Poznaj kroki, prawa i checklistę, by uniknąć błędów. Sprawdź teraz!

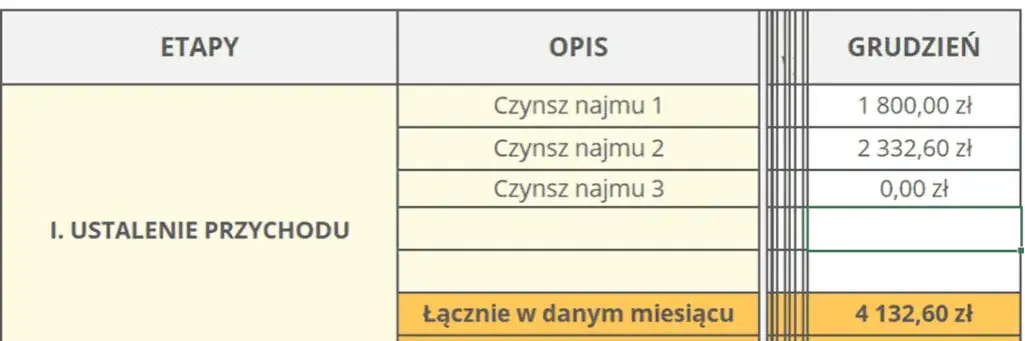

Podatek od najmu 2026: Ryczałt krok po kroku oblicz i zapłać

Podatek od najmu 2026: Ryczałt krok po kroku oblicz i zapłaćOblicz i zapłać podatek od najmu prywatnego 2026! Przewodnik po ryczałcie: stawki, terminy, PIT-28. Sprawdź, jak rozliczyć się prosto.

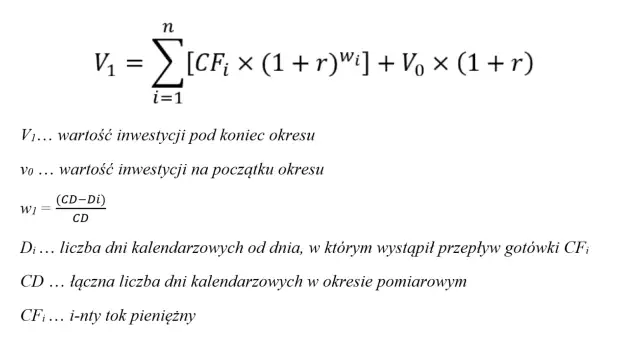

Oblicz realną stopę zwrotu z najmu mieszkania! Dowiedz się, jak uwzględnić wszystkie koszty, wzory ROI i ROE oraz uniknąć błędów. Sprawdź nasz poradnik.

Szukasz mieszkania w Turcji? Sprawdź aktualne ceny wynajmu, koszty (czynsz, aidat, media) i niezbędne formalności dla Polaków. Dowiedz się, jak się przygotować!

Planujesz wynajem mieszkania w Belgii? Sprawdź przewodnik po cenach, kaucjach, mediach i dodatkowych opłatach. Poznaj kluczowe czynniki wpływające na koszt i praktyczne porady.

Rozliczasz najem prywatny w 2026? Odkryj, jak płacić ryczałt od przychodów, jakie stawki obowiązują i kiedy złożyć PIT-28. Sprawdź nasz poradnik!

Ubezpieczenie mieszkania w bloku: czy warto? Sprawdź zakres i cenę

Ubezpieczenie mieszkania w bloku: czy warto? Sprawdź zakres i cenęDowiedz się, dlaczego warto ubezpieczyć mieszkanie w bloku. Poznaj zakres ochrony, koszty i kluczowe czynniki przy wyborze polisy. Sprawdź nasz poradnik!

Kompletna lista dokumentów do umowy przedwstępnej sprzedaży mieszkania

Kompletna lista dokumentów do umowy przedwstępnej sprzedaży mieszkaniaPotrzebujesz listy dokumentów do umowy przedwstępnej sprzedaży mieszkania? Sprawdź nasz kompletny przewodnik po wymaganiach dla sprzedającego i kupującego.

Zwolnienie z PCC za pierwsze mieszkanie: Od kiedy i jak oszczędzić?

Zwolnienie z PCC za pierwsze mieszkanie: Od kiedy i jak oszczędzić?Dowiedz się, od kiedy obowiązuje zwolnienie z PCC przy zakupie pierwszego mieszkania (rynku wtórnego). Sprawdź warunki i oszczędź 2% wartości nieruchomości!

Ile farby na mieszkanie 50 m²? Obliczamy idealną ilość

Ile farby na mieszkanie 50 m²? Obliczamy idealną ilośćPlanujesz malowanie mieszkania 50 m²? Oblicz dokładnie potrzebną ilość farby. Dowiedz się, jak oszczędzić czas i pieniądze dzięki naszemu poradnikowi!

Idealne mieszkanie na wynajem: przewodnik po wyborze i cenie

Idealne mieszkanie na wynajem: przewodnik po wyborze i cenieSzukasz mieszkania na wynajem? Odkryj kompleksowy przewodnik po typach mieszkań, budżecie, lokalizacji i kluczowych aspektach wyboru. Znajdź swoje idealne lokum!

Kiedy płacisz czynsz za mieszkanie? Akt notarialny vs. protokół

Kiedy płacisz czynsz za mieszkanie? Akt notarialny vs. protokółOd kiedy płacisz czynsz za mieszkanie? Dowiedz się, że obowiązek powstaje od wydania lokalu, nie aktu notarialnego. Uniknij pułapek!

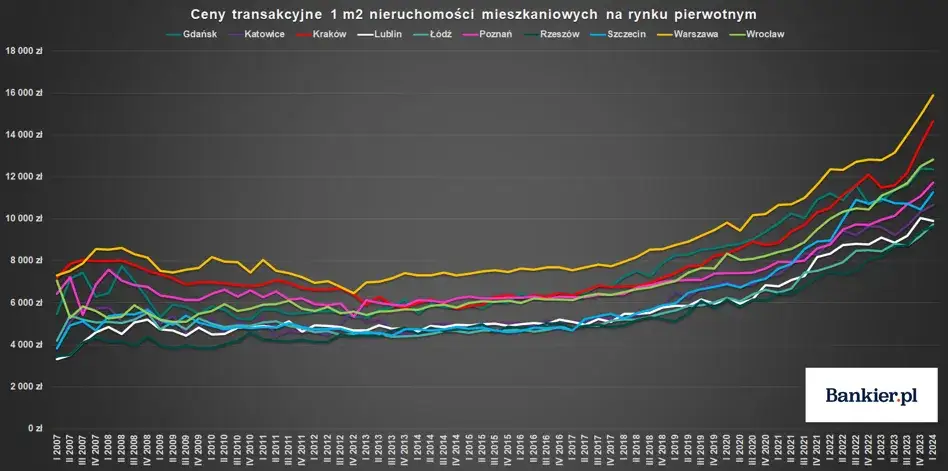

Ceny mieszkań w Polsce: Analiza, prognozy i gdzie kupić taniej

Ceny mieszkań w Polsce: Analiza, prognozy i gdzie kupić taniejPoznaj aktualne ceny mieszkań w Polsce, kluczowe czynniki wpływające na koszty i prognozy rynkowe. Sprawdź, gdzie kupić taniej i jak wybrać mądrze!

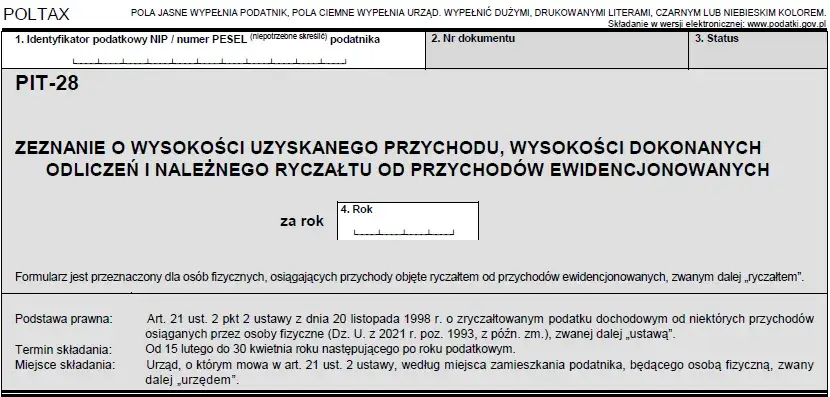

PIT-28 najem prywatny: termin 30 kwietnia 2026. Jak rozliczyć?

PIT-28 najem prywatny: termin 30 kwietnia 2026. Jak rozliczyć?PIT-28 za najem prywatny 2025: Zobacz ostateczny termin (30 kwietnia 2026), stawki ryczałtu i uniknij kar. Sprawdź nasz przewodnik!